Connect API

- UX Research

- Product Design

- Creative Direction

- Business Strategy

Connect by Plastiq revolutionizes API payments with its PCI-compliant widget, offering secure, seamless ACH/debit and credit payments integration into customer platforms, shaping the future of financial transactions.

The market lacked a flexible solution capable of accommodating both payers and vendors while ensuring seamless transactions across various payment methods. Vendors traditionally not accepting card payments faced complexities, compounded by high merchant fees and low security.

Additionally, there was no comprehensive framework to address these challenges, leaving a significant gap in the market for a solution that could streamline processes, reduce costs, and enhance security measures. This lack of an integrated approach hindered the efficiency and effectiveness of financial transactions, creating a great need for an innovative solution that could bridge these gaps and meet the diverse needs of both payers and vendors.

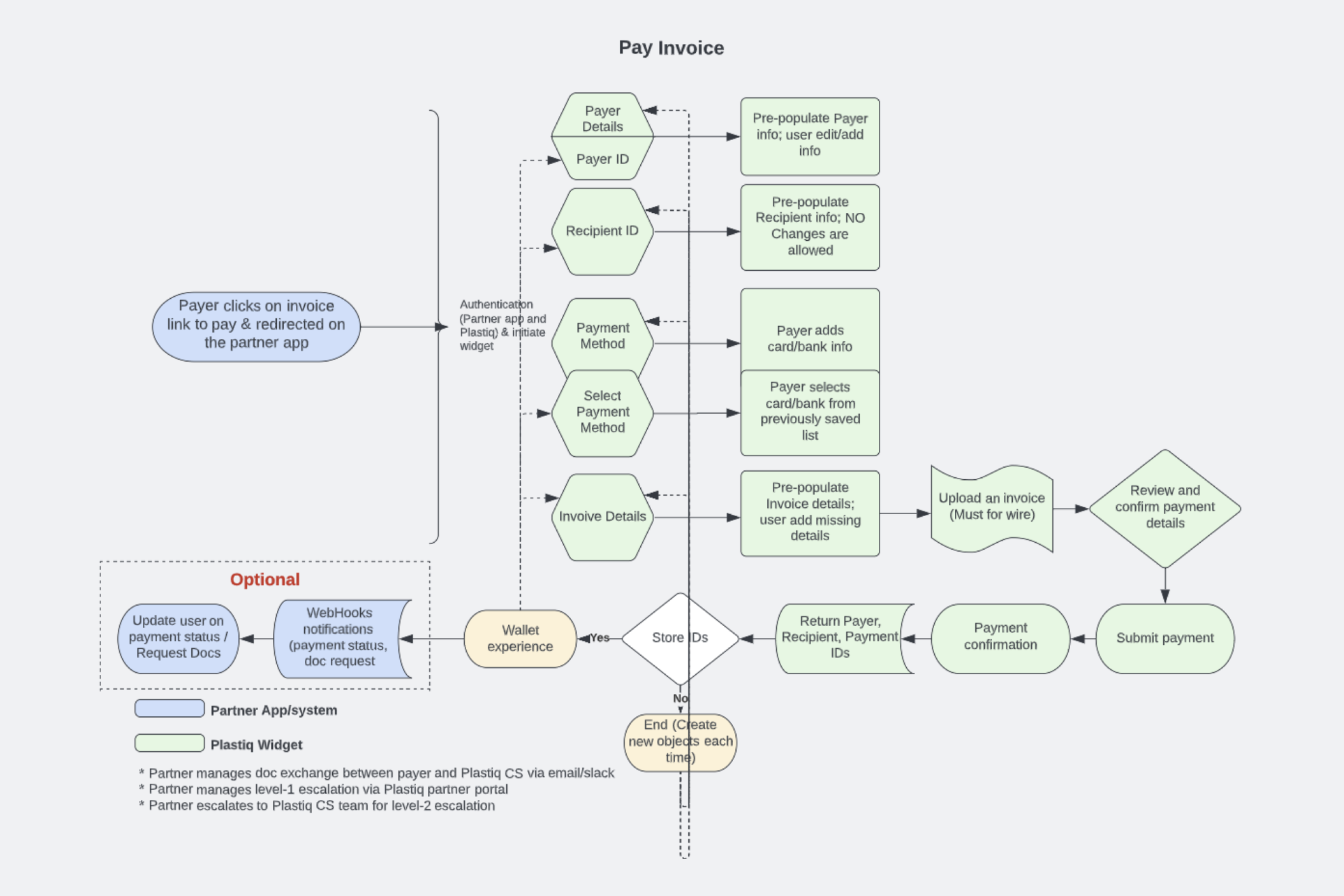

The Process

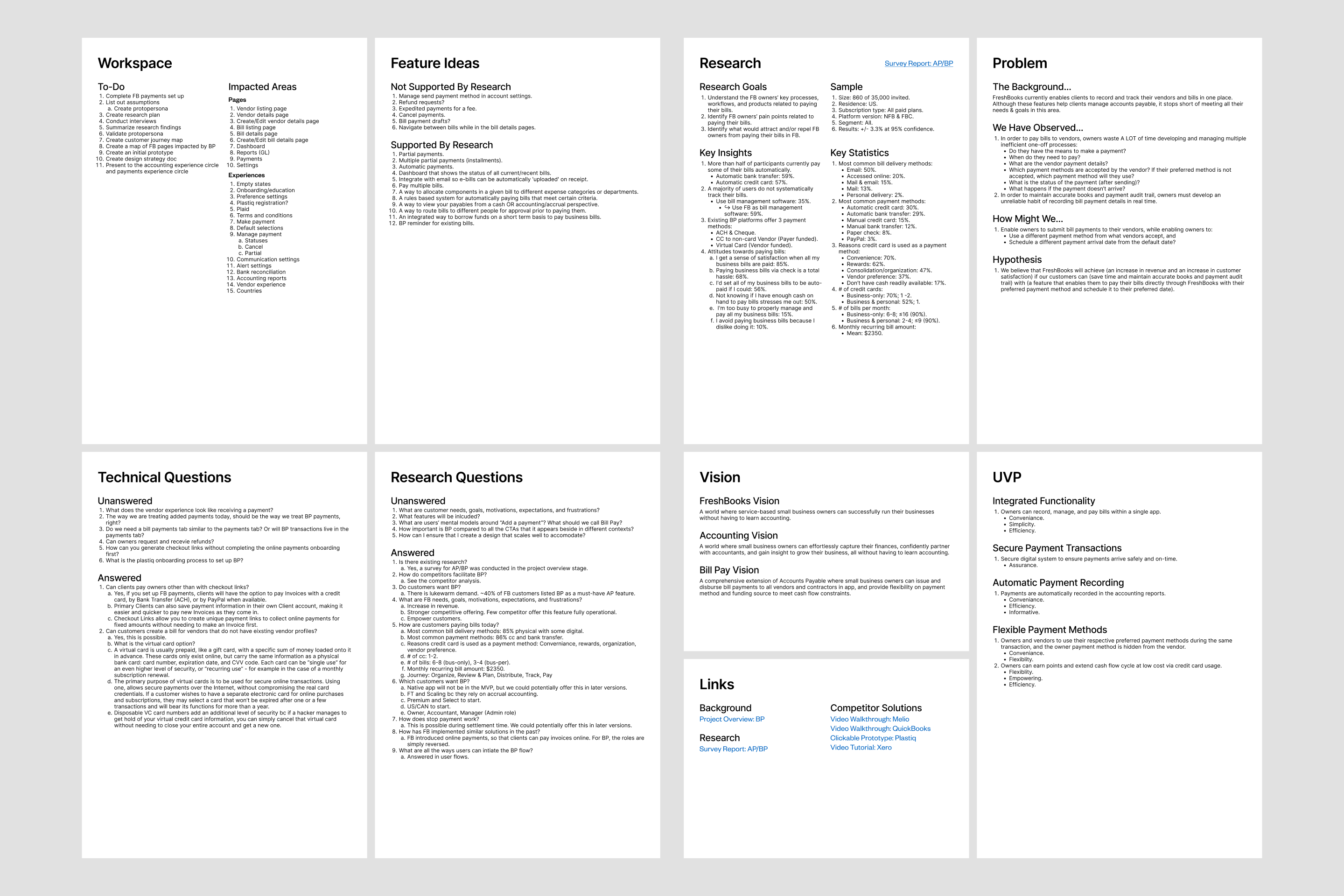

To establish a clear product vision, I engaged in close collaboration with the entire team, including the product manager and engineers, over the course of a couple months. During the sessions, I was able to formulate and implement a meticulous design strategy through daily collaboration sessions.

I leveraged institutional knowledge from team members, combined with extensive competitor research data, technical inquiries, and newly identified key proto-personas I created to guide me into curating proper solutions.

Through relentless iteration of wireframing and prototyping, I crafted a solution that not only met business requirements but also ensured a seamless onboarding experience for potential clients. By embracing adaptability and aligning with the collective aspirations our team engineered a solution that embodied the synergy of innovation and user-centric design.

The Solution

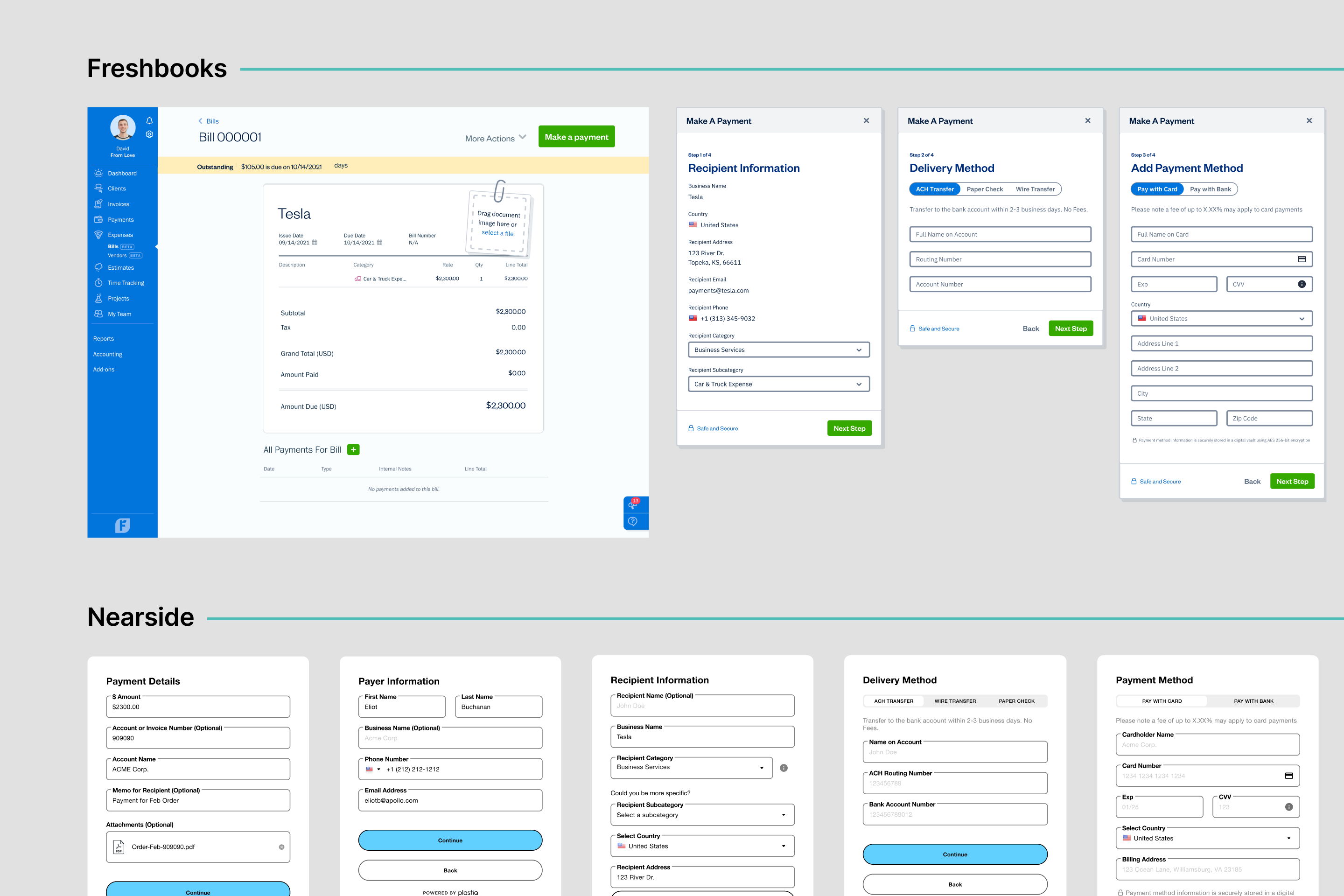

The revolutionary Plastiq Connect API was conceived to revolutionize the financial ecosystem, setting a new standard for seamlessness and innovation.

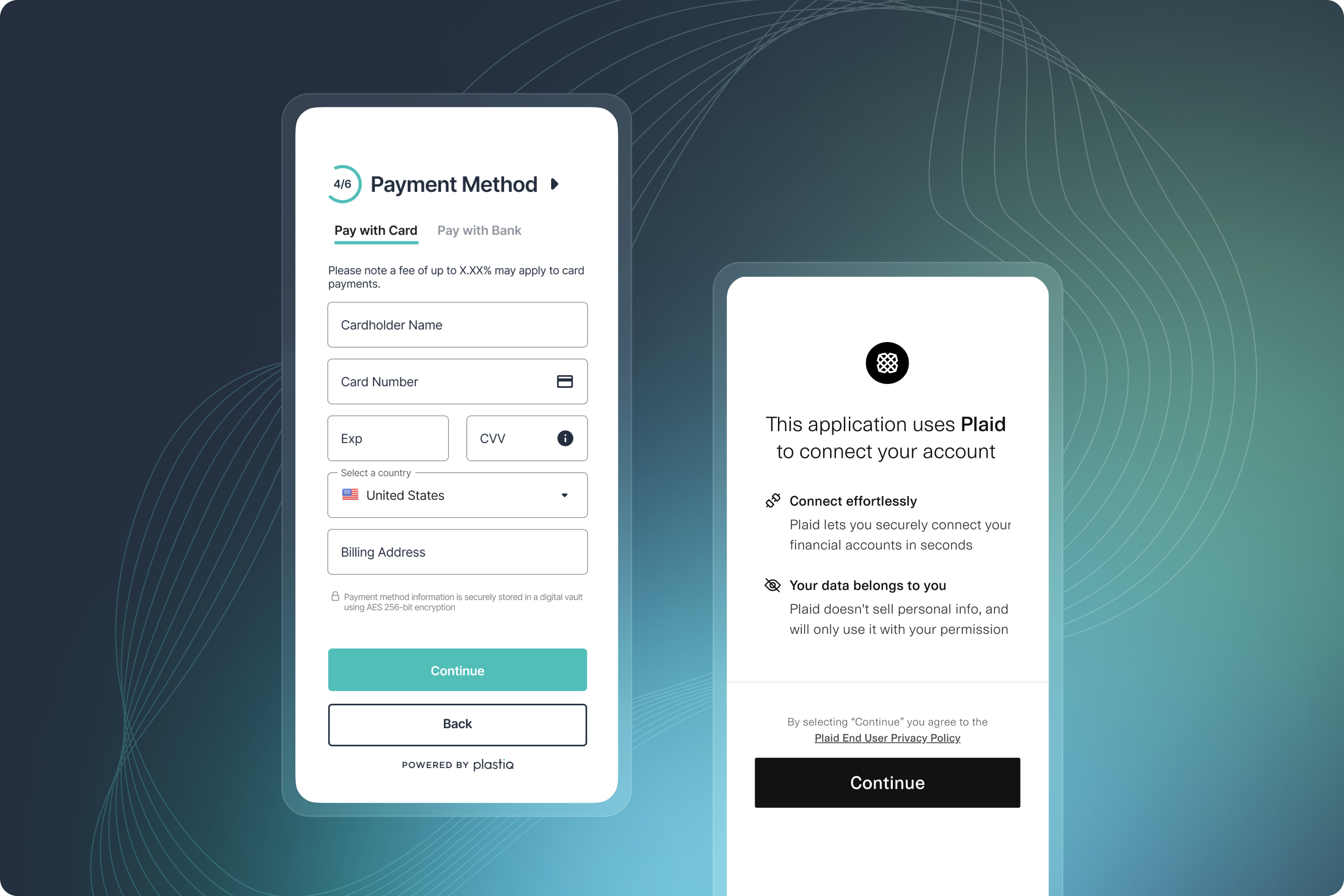

This solution adeptly tackled the complexities of API payments by offering a flexible platform for both payers and vendors, ensuring smooth transactions across diverse payment methods. Connect eliminates merchant fees, streamlines payment processes for sellers, and empowers buyers to pay vendors by card, regardless of traditional limitations. Clients' customers can conveniently use their preferred payment method.

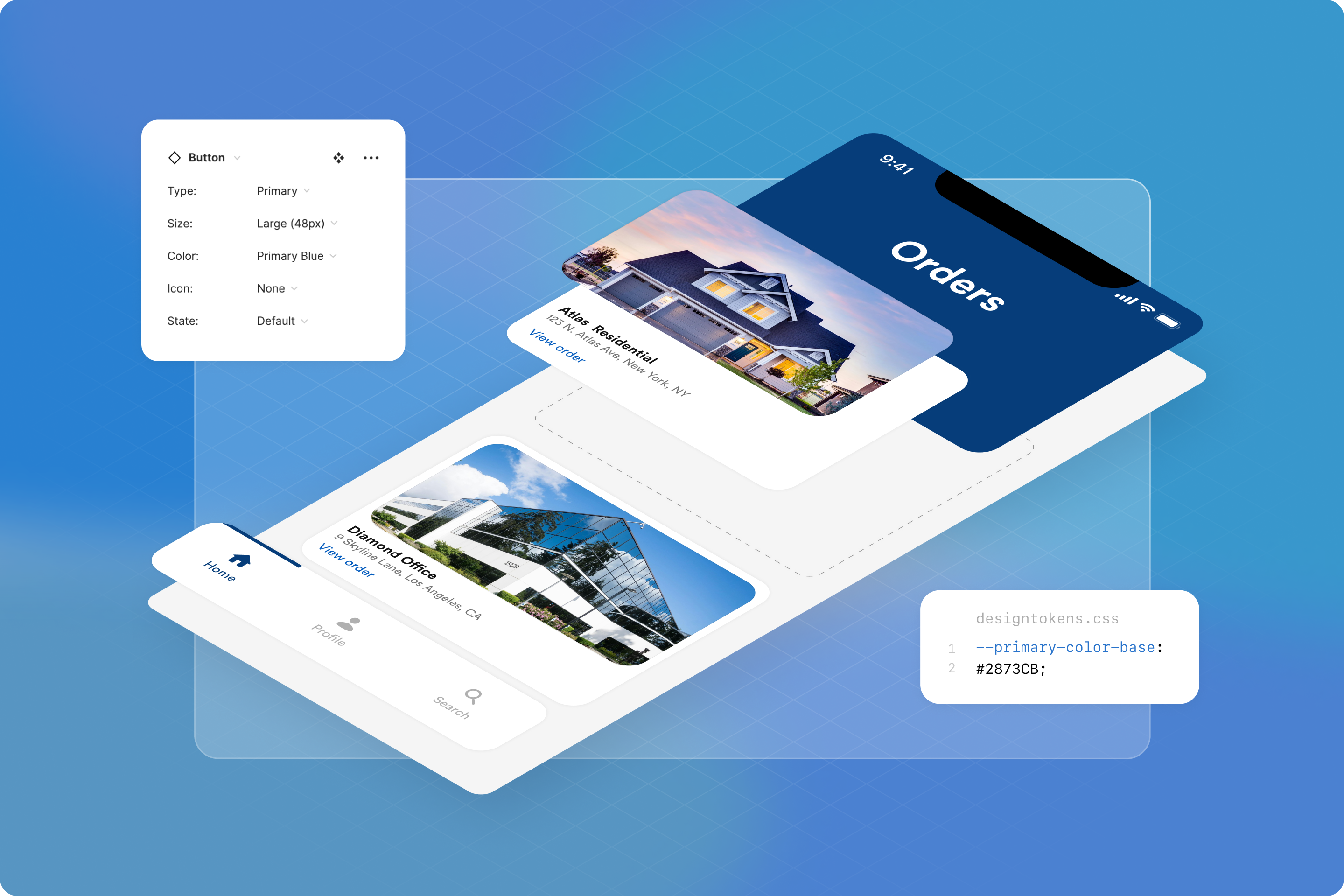

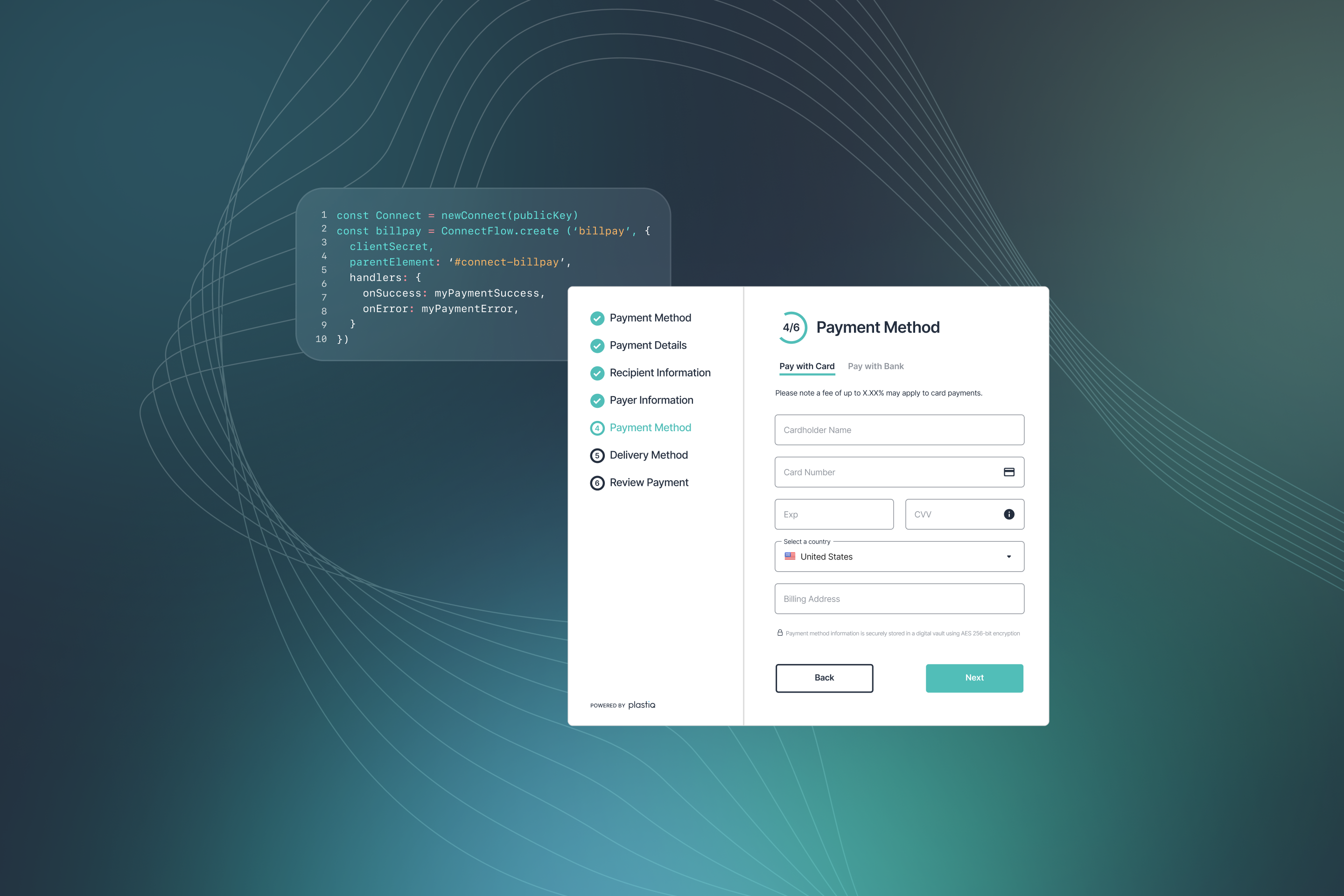

Effortless integration.

Clients seamlessly integrate the Connect API into existing pay flows, whether it's their website, legacy processes, or checkout flow. For added convenience, the Connect API incorporates Plaid into the system, supporting seamless bank and card connectivity.

Powerful partner portal.

Onboarding is a breeze with the Connect developer-supported integration and robust partner portal. The portal also features comprehensive business analytics on all transactions for effortless accounting.

Unbreakable security and compliance.

Security is fortified with PCI Level 1 certification and bank-grade measures, resulting in minimal fraud rates. Additionally, this service aims to enhance sellers' working capital and establish a comprehensive framework for capturing additional revenue and valuable insights from in-product customer payments.

Impact

- $20M monthly payment volume post-launch

- Partnered w/ Brex, Billfire, & Payground

- Forbes "Fintech Startups Top 50"